TriggerPhoto

Introduction

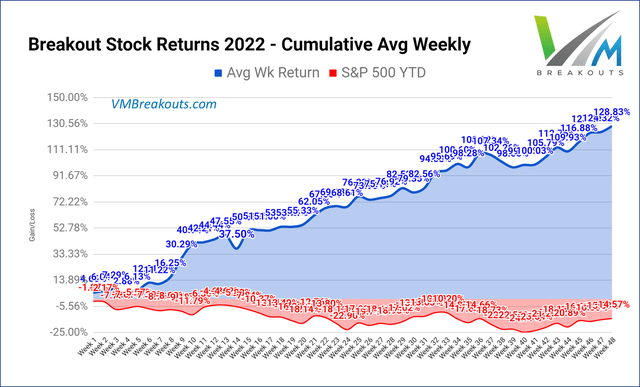

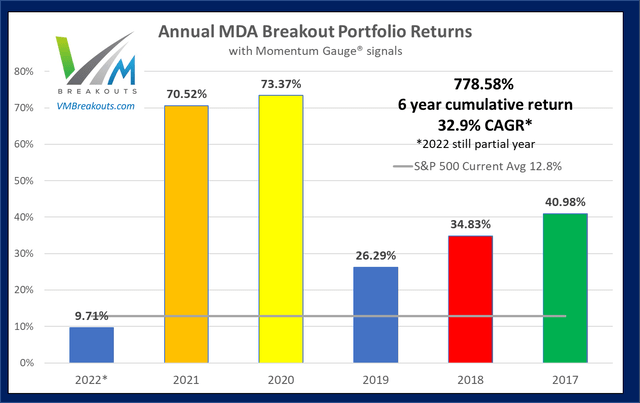

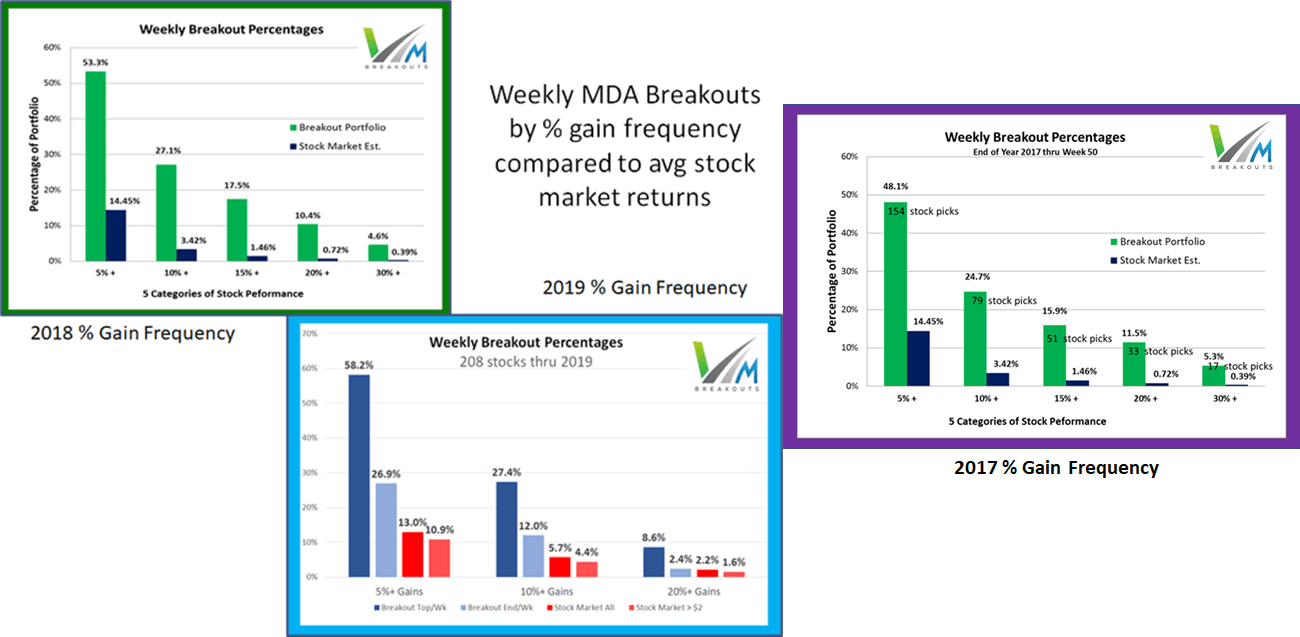

The Weekly Breakout Forecast continues my doctoral analysis evaluation on MDA breakout choices over greater than 7 years. This excessive frequency breakout subset of the totally different portfolios I repeatedly analyze has now exceeded 280 weeks of public choices as a part of this ongoing stay forward-testing analysis. The frequency of 10%+ returns in every week is averaging over 4x the broad market averages prior to now 5+ years.

In 2017, the pattern measurement started with 12 shares, then 8 shares in 2018, and at members’ request since 2020, I now generate solely 4 choices every week. As well as 2 Dow 30 picks are supplied, in addition to a brand new lively ETF portfolio that competes in opposition to a sign ETF mannequin. Month-to-month Development & Dividend MDA breakout shares proceed to beat the market annually as effectively. I supply 11 prime fashions of brief and long-term worth and momentum portfolios which have crushed the S&P 500 since my buying and selling research have been made public.

Market Outlook

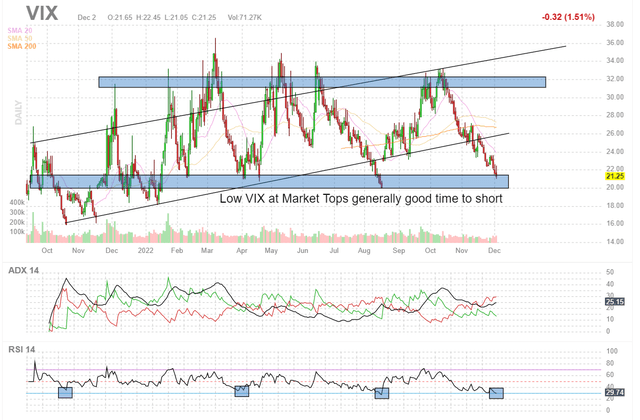

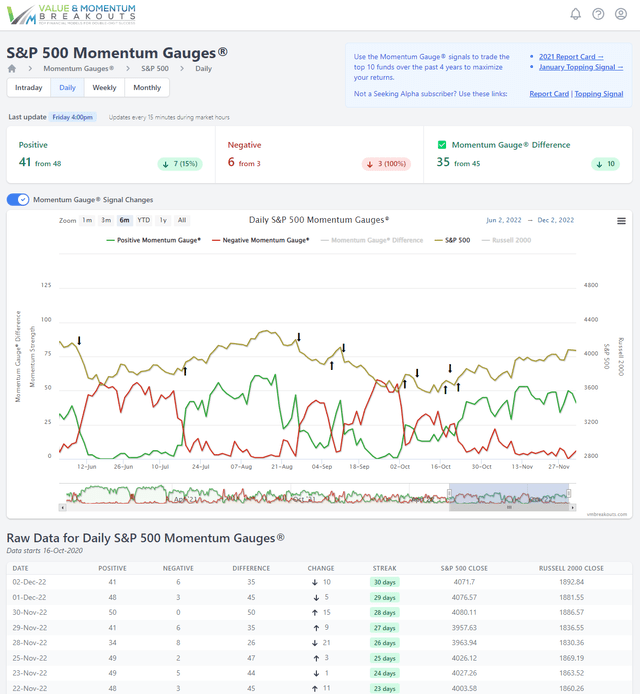

The Momentum Gauges® proceed optimistic in extraordinarily excessive market volatility. November began with the biggest ever selloff response to a Fed FOMC fee hike. We have now seen two very giant rallies following response to declining CPI inflation information and extra just lately after Chairman Powell spoke this week about lowering fee hikes. Financial information stays weak and it might not take a lot to trigger one other leg decrease throughout file excessive QT exercise. Extra of those unimaginable charts are detailed right here and within the chat rooms.

FinViz.com

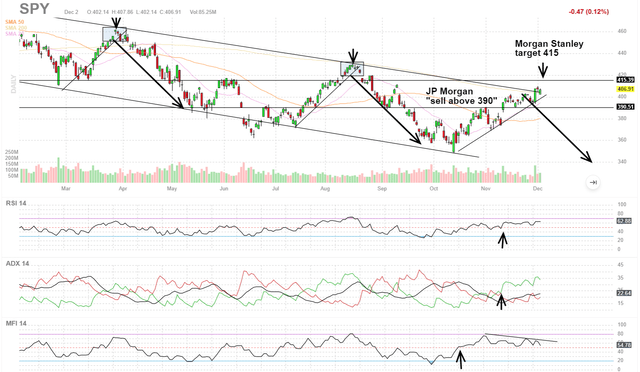

I’m anticipating the S&P 500 market sample to comply with with one other leg decrease. The timing needs to be in line with the VIX reaching the bottom ranges for the reason that April and August market peaks. A market reversal may coincide with the subsequent FOMC assembly and fee hike choice on December thirteenth.

FinViz.com VMBreakouts.com

We’re nonetheless in a sample of bearish rallies in an extended destructive channel from November 2021. There are sturdy similarities to the volatility and patterns of 2018 and 2008 with buyers very cautious. Comply with the Momentum Gauges and be prepared for extra swift adjustments.

The S&P 500 is now testing the highest of the destructive channel in 2022 proven under after breaking 4100 briefly on December 1st. S&P 500 closed at 4066 on Friday.

FinViz.com VMBreakouts.com

Morgan Stanley chief strategist says “buy-the-dip” however be careful for an additional pull again after the S&P 500 strikes above 4100. Resistance raised to 4150. Wall Avenue’s Largest Bear Buys The Dip: “I Do not Suppose This Rally Is Over”

JPMorgan says do not buy right here, you ought to be promoting into S&P 500 above 3900. “We See Extra Promoting Into Power Right here”: Why JPM’s Buying and selling Desk Is not Shopping for This Rally

JPMorgan has modified from a bullish outlook to a base case of recession into 2023: JPM Makes 2023 Recession Its Base Case, Expects Million Jobs Misplaced By Mid-2024

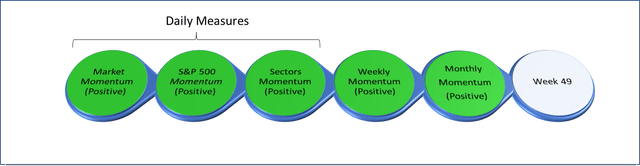

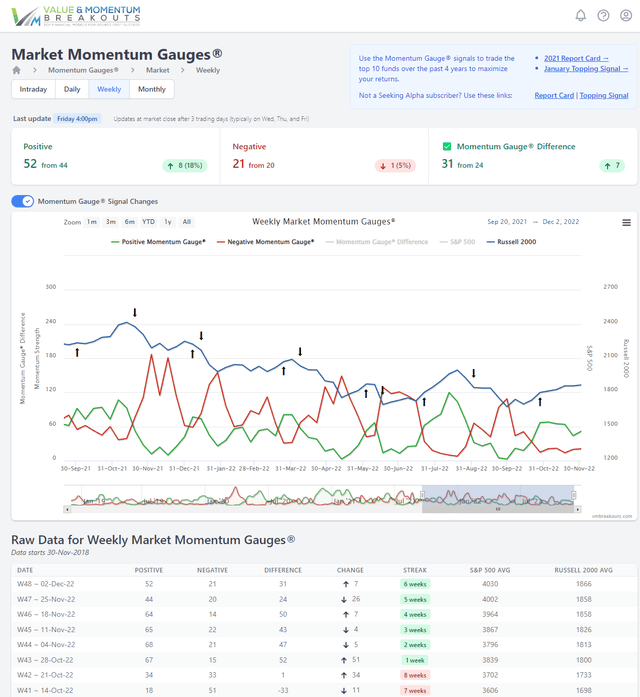

Momentum Gauges® Stoplight forward of Week 49. The Inventory Market and S&P 500 momentum gauges are optimistic from October and the weekly gauges proceed optimistic right into a sixth consecutive week. The sector gauges have turned extra optimistic with almost all sectors optimistic once more.

VMBreakouts.com

The primary stage of weekly and month-to-month sector gauges have been launched on the automated Momentum Gauge web site to the general public!

Weekly Momentum Gauges proceed optimistic for a sixth consecutive week however with rising destructive momentum from the bottom ranges since August.

app.VMBreakouts.com

S&P 500 Day by day Momentum Gauges proceed optimistic from October twenty first with very excessive market volatility. The gauges at the moment are within the longest optimistic sign for 2022. Constructive momentum is declining for the final 2 days and destructive momentum growing.

app.VMBreakouts.com

Present Returns

To this point YTD 2022 there are 127 picks in 48 weeks beating the S&P 500. 100 picks are beating the S&P 500 by over 10%+ in double digits. Main MDA gainers embody (NUVL) +77.8%, (CLFD) +96.7%, (FUTU) 51.8%, (MNRL) +67.4%, (RES) +102.63%, (TDW) +175.6%, (ZYME) +43.7%, (VRDN) +113.5%, (ZYXI) +74.7%.

Regardless of such excessive destructive momentum situations all yr, 50 picks in 48 weeks have gained a minimum of 9.9% in lower than every week. Moreover, 106 picks in 47 weeks have gained over 5% in lower than every week in these excessive frequency breakout choices, regardless of many shortened vacation weeks.

VMBreakouts.com

Extra background, measurements, and excessive frequency breakout information on the Weekly MDA Breakout mannequin is right here: Worth And Momentum MDA Breakouts +70.5% In 52 Weeks: Last 2021 12 months Finish Report Card

These are extremely vital statistical outcomes which might be additional improved by following the Momentum Gauge alerts with solely 14 optimistic buying and selling weeks this yr. Worst case minimal returns following the MG buying and selling alerts are beating the S&P 500 YTD by +14.5%.

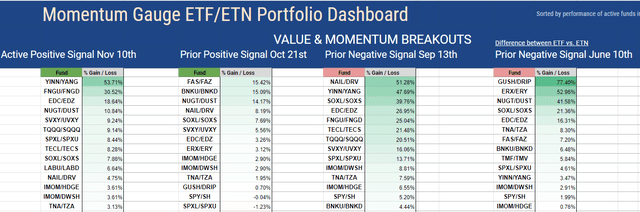

Leveraging The Momentum Gauges With ETFs

Along with timing MDA breakout inventory picks for the perfect returns, the gauges are used for stay ETF bull/bear timing alerts with sturdy outcomes.

VMBreakouts.com

Historic Efficiency Measurements

Historic MDA Breakout minimal purchase/maintain returns are at +70.5% YTD when buying and selling solely within the optimistic weeks in line with the optimistic Momentum Gauges® alerts. Remarkably, the frequency streak of 10% gainers inside a 4- or 5-day buying and selling week continues at extremely statistically vital ranges above 80% not counting frequent a number of 10%+ gainers in a single week.

VMBreakouts.com

V&M Multibagger Listing

Long term many of those choices be part of the V&M Multibagger listing now at 117 weekly picks with over 100%+ features, 60 picks over 200%+, 19 picks over 500%+ and 11 picks with over 1000%+ features since January 2019 reminiscent of:

- Celsius Holdings (CELH) +2,401.7%

- Enphase Vitality (ENPH) +2,329.5%

- Northern Oil and Gasoline (NOG) +1,240.5%

- Trillium Therapeutics (TRIL) +1008.7%

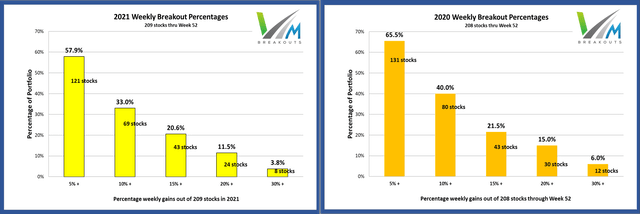

Greater than 300 shares have gained over 10% in a 5-day buying and selling week since this MDA testing started in 2017. A frequency comparability chart is on the finish of this text. Readers are cautioned that these are extremely unstable shares that is probably not applicable for attaining your long run funding objectives: Easy methods to Obtain Optimum Asset Allocation

The Week 49 – 2022 Breakout Shares for subsequent week are:

The picks for subsequent week encompass 1 Vitality, 1 Healthcare, 1 Fundamental Supplies and 1 Client Defensive sector shares. These shares are measured from launch to members upfront each Friday morning close to the open for the perfect features. Prior choices could also be doing effectively, however for analysis functions I intentionally don’t duplicate choices from the prior week. These choices are primarily based on MDA traits from my analysis, together with sturdy cash flows, optimistic sentiment, and powerful fundamentals — however readers are cautioned to comply with the Momentum Gauges® for the perfect outcomes.

- Catalyst Prescribed drugs (CPRX) – Healthcare / Biotechnology

- Important Farms (VITL) – Client Defensive / Farm Merchandise

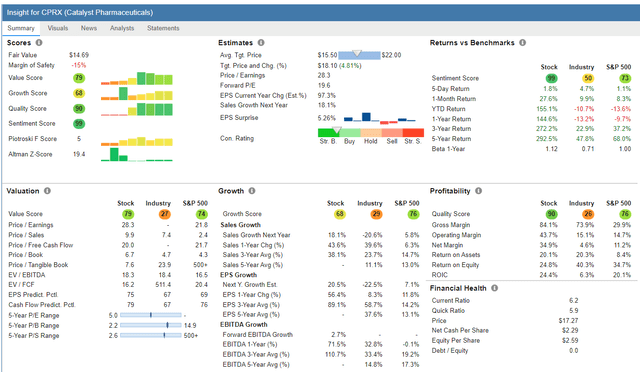

Catalyst Prescribed drugs – Healthcare / Biotechnology

FinViz.com

Value Goal: $20.00/share (Analyst Consensus + Technical See my FAQ #20)

(Supply: Firm Assets)

Catalyst Prescribed drugs, Inc., a commercial-stage biopharmaceutical firm, focuses on growing and commercializing therapies for folks with uncommon debilitating, continual neuromuscular, and neurological ailments in the US. It affords Firdapse, an amifampridine phosphate tablets for the therapy of sufferers with lambert-eaton myasthenic syndrome; and Ruzurgi for the therapy of pediatric LEMS sufferers.

StockRover.com

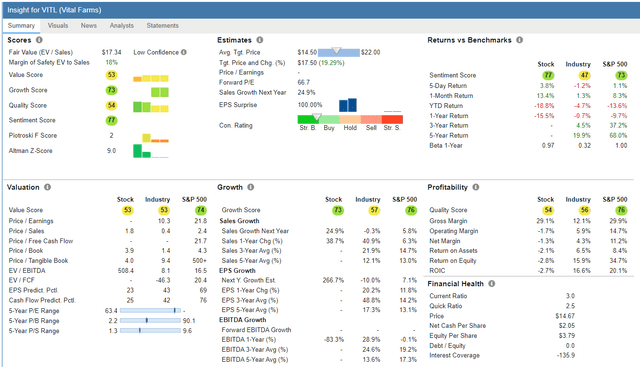

Important Farms – Client Defensive / Farm Merchandise

FinViz.com

Value Goal: $20.00/share (Analyst Consensus + Technical See my FAQ #20)

(Supply: Firm Assets)

Important Farms, Inc., an moral meals firm, offers pasture-raised merchandise in the US. It affords shell eggs, butter, hard-boiled eggs, ghee, liquid entire eggs, and egg chunk merchandise.

StockRover.com

Prime Dow 30 Shares to Look ahead to Week 49

First, make sure you comply with the Momentum Gauges® when making use of the identical MDA breakout mannequin parameters to solely 30 shares on the Dow Index. Circumstances have delivered the worst first half to the inventory market since 1970. Second, these choices are made with out regard to market cap or the below-average volatility typical of mega-cap shares that will produce good outcomes relative to different Dow 30 shares. The newest picks of weekly Dow choices in pairs for the final 5 weeks:

| Image | Firm | Present % return from choice Week |

| V | Visa Inc. | +1.81% |

| (VZ) | Verizon | -2.15% |

| (HON) | Honeywell Worldwide | +2.12% |

| (V) | Visa Inc. | +3.25% |

| CVX | Chevron Corp. | -2.03% |

| DOW | Dow Inc. | -0.73% |

| (NKE) | NIKE Inc. | +17.13% |

| (DOW) | Dow Inc. | +5.14% |

| CVX | Chevron Corp. | -0.78% |

| (INTC) | Intel Corp. | +3.45% |

If you’re in search of a much wider choice of giant cap breakout shares, I like to recommend these long run portfolios. The brand new mid-year choices have been launched to members to start out July:

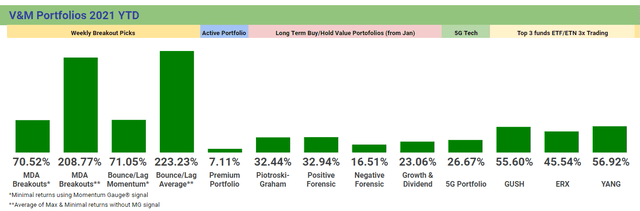

Piotroski-Graham enhanced worth –

- July midyear at +10.60%

- January portfolio beating S&P 500 by +28.67% YTD.

Constructive Forensic –

- July midyear down -9.35%

- January Constructive Forensic beating S&P 500 by +9.96% YTD.

Adverse Forensic –

- July midyear down -22.22%

- January Adverse Forensic beating S&P 500 by +31.26% YTD

Development & Dividend Mega cap breakouts –

- July midyear up +0.21%

- January portfolio beating S&P 500 by +10.83% YTD

These long-term choices are considerably outperforming many main Hedge Funds and all of the hedge fund averages since inception. Think about the actively managed ARK Innovation fund down -59.66% YTD, Tiger International Administration -58% YTD.

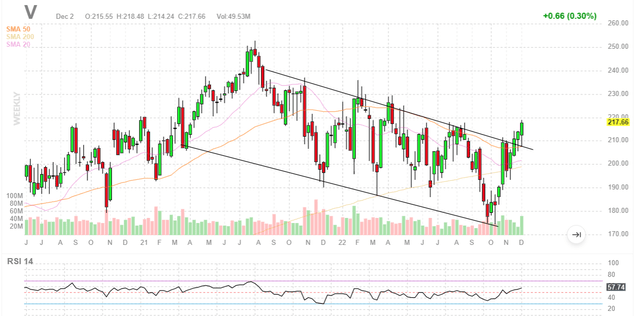

The Dow picks for subsequent week is:

Visa

Visa has been chosen three weeks in a row and continues sturdy breakout situations after beating on earnings October twenty fifth. It has cleared the highest of the destructive channel on the weekly chart from November 2021. Analysts have upgraded with a consensus value goal is 249/share again to peak 2021 ranges. US shopper credit score ranges are on the highest ranges in many years with the best rates of interest since 2008. Deutsche Financial institution value goal is $260/share at new all-time highs.

FinViz.com

Background on Momentum Breakout Shares

As I’ve documented earlier than from my analysis through the years, these MDA breakout picks have been designed as excessive frequency gainers.

These documented excessive frequency features in lower than every week proceed into 2020 at charges greater than 4 occasions greater than the common inventory market returns in opposition to comparable shares with a minimal $2/share and $100 million market cap. The improved features from additional MDA analysis in 2020 are each bigger and extra frequent than in earlier years in each class. ~ The 2020 MDA Breakout Report Card

The frequency percentages stay similar to returns documented right here on In search of Alpha since 2017 and at charges that enormously exceed the features of market returns by 2x and as a lot as 5x within the case of 5% features.

VMBreakouts.com

The 2021 and 2020 breakout percentages with 4 shares chosen every week.

VMBreakouts.com

MDA choices are restricted to shares above $2/share, $100M market cap, and larger than 100k avg every day quantity. Penny shares effectively under these minimal ranges have been proven to profit enormously from the mannequin however introduce rather more danger and could also be distorted by inflows from readers deciding on the identical micro-cap shares.

Conclusion

These shares proceed the stay forward-testing of the breakout choice algorithms from my doctoral analysis with steady enhancements over prior years. These Weekly Breakout picks encompass the shortest length picks of seven quantitative fashions I publish from prime monetary analysis that additionally embody one-year purchase/maintain worth shares.

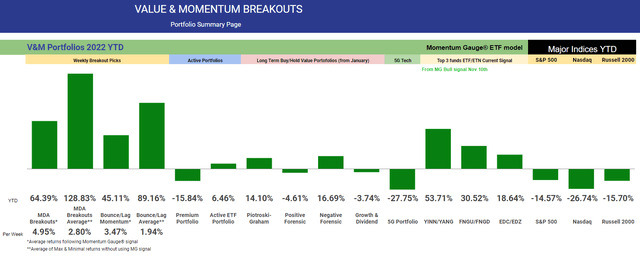

All of the V&M portfolio fashions are beating the market indices by means of the worst 6 month begin since 1970, file inflation and Fed tightening intervention. New mid-year worth portfolios are once more main the main indices to start out the subsequent long run purchase/maintain interval.

VMBreakouts.com

The ultimate 2021 returns for the totally different portfolio fashions from January of final yr are proven under.

VMBreakouts.com

All the perfect to you, keep protected and wholesome and have a terrific week of buying and selling!

JD Henning, PhD, MBA, CFE, CAMS